All Related Articles

Senate Passes Additional Funding for Small Business Relief, But Questions Remain on the Deductibility of PPP Expenses

The sooner federal policymakers or regulators clarify tax questions about the Paycheck Protection Program (PPP), the more certainty firms will have when they accept the economic relief to keep their businesses afloat.

3 min read

Will States Tax the Federal Government’s COVID-19 Lifeline to Small Businesses?

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

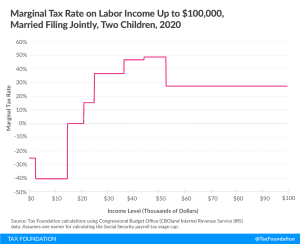

Trade-offs of Delaying Tax Filing and Instituting a Payroll Tax Holiday on Businesses and Individuals

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

Evaluating the Trade-offs of Small Business Relief Provisions of the CARES Act

The small business provisions in the CARES Act support small businesses and nonprofits seeking economic relief during this downturn. However, creating multiple programs with overlapping purposes and differing qualification requirements makes relief more complicated, vague, and not neutral.

6 min read

Understanding the Paycheck Protection Program in the CARES Act

Many small business owners are seeking guidance as they apply for loans backed by the Small Business Administration (SBA) to help maintain cash flow and retain workers even as more states announce new quarantine and shelter-in-place orders.

5 min read

Tax Expenditures Taken by Small Businesses in the Federal Tax Code

The expenditures offered to small businesses are not created equal. We review the tax expenditures small businesses rely on most.

3 min read

Business in America

Who are the workers, consumers, and shareholders who interact with businesses in the U.S.? What forms do these businesses take? How do business taxes impact people’s lives? It is essential we answer these questions in order to design a business tax system that is simple, efficient, and enables economic progress.

5 min read

2017 GDP and Employment by Industry

In the U.S. economy, there are tens of millions of businesses, including more than 30 million pass-through businesses and more than a million C corporations. Most output and employment come from firms that provide services to consumers—such as education, health care, and social assistance services—though a large share of output and employment still comes from firms in production industries, particularly manufacturing.

2 min read

Firm Variation by Employment and Taxes

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

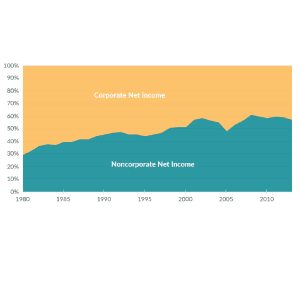

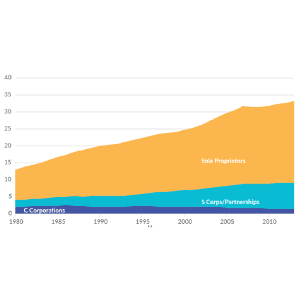

Corporate and Pass-through Business Income and Returns Since 1980

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

Unequal Tax Treatment Is Contributing to Rising Debt Levels for Entrepreneurs

A recent paper discusses two main trends related to U.S. entrepreneurs: the decrease in the number of entrepreneurs and the increase in their borrowing. Entrepreneurs have increased their debt holdings relative to their assets over the past three decades.

3 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read